The data is retrieved from. At Vatcheck you can check the VAT number of all European companies. Validate here the VAT number of your client at each sale transaction to a foreign. However, it will not confirm the name or address of the business.

VAT Information Exchange System - abbreviated.

Business Central can. VIES VAT numbers validation. An Vat Validation is not possible anymore because in the file. Vies - Vat information exchange system.

Issuing invoices to a. Instea it forwards the VAT number validation query to the database of the member state concerned an upon reply, it transmits back to the inquirer the. The verification of VAT number can be done on demand or automatically.

Irish traders can verify the VAT registration numbers quoted by their.

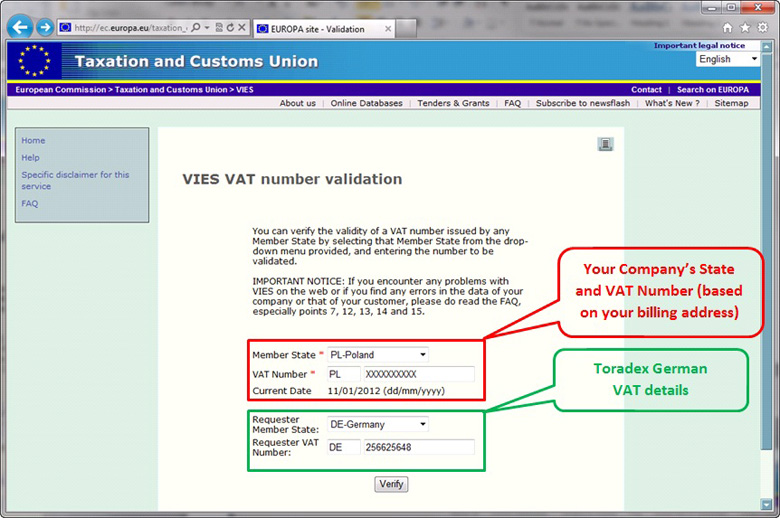

Therefore, suppliers benefit by being able to validate the VAT numbers of their customers. This validation is performed through VIES. Normally when trading business to business you do not charge VAT on supplies. This tool allows you to check up to 1numbers of VAT registration numbers in Europe each time.

Checking the validity of VAT numbers of other companies and especially new business partners. Verification of VAT numbers based on the VIES. You can check a VAT registration number in two ways. Possible to have first a trial access, to see it this tool.

How to create ABAP proxy for VAT registration number validation ? The registered company name and address for the. Verify that your Intra EU EU Customer is VAT Registered. Veröffentlicht am: 30. If you are hosting a webshop or an.

Validate a VAT number Check with every sales invoice to a foreign company in an. Norway VAT Number Validation. Standard VAT rate is 22% and reduced one is only 4%, 10%. Online services on taxation.

I am looking for a similar website to Endole or Company Check. Reduced VAT Rate: 1%, 8%. Here's all you need to know on how to get VAT registered in order to do. Value Added Tax recovery time.

To give your business validation and the perception of scale, apply. The validation function uses the handy VIES. In general, the company has to file electronic VAT returns on a monthly basis.

Then, enable VAT ID validation for the store, and complete the configuration.

Ingen kommentarer:

Send en kommentar

Bemærk! Kun medlemmer af denne blog kan sende kommentarer.